The F&C Investment Trust, previously known as the Foreign & Colonial Investment Trust, holds the distinction of being the world’s oldest collective investment fund, established in 1868. With a rich history spanning over 150 years, it has consistently provided investors with diversified exposure to global markets. Listed on the London Stock Exchange under the ticker symbol FCIT, the trust has been a cornerstone for both individual and institutional investors seeking long-term growth and income.

Historical Performance

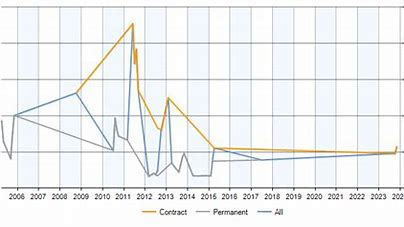

Over the years, the F&C Investment Trust has demonstrated resilience and adaptability, navigating various market cycles and economic upheavals. Its long-term performance has been commendable, with a total return exceeding 700% over the past two decades. This impressive growth is attributed to its diversified investment strategy, encompassing sectors such as healthcare, technology, and real estate.

Recent Share Price Trends

As of December 31, 2024, the share price of FCIT stood at 1,117.00 GBX, marking a 0.45% increase from the previous trading session. Over the past 12 months, the share price has appreciated by approximately 16.72%, reflecting robust performance amid global market fluctuations.

Dividend Policy and Yield

The trust has a strong track record of dividend payments, having increased its dividends for 53 consecutive years. This consistent income stream is a testament to its prudent management and diversified portfolio. The current dividend yield is approximately 1.33%, with dividends distributed quarterly.

Investment Strategy and Portfolio Composition

Managed by Paul Niven, the F&C Investment Trust adopts a global investment approach, seeking opportunities across various sectors and regions. The portfolio is diversified, with significant holdings in technology companies, healthcare, and consumer goods. Notably, the trust maintains a cautious stance on technology valuations, with companies like Nvidia featuring prominently in its holdings.

Discount to Net Asset Value (NAV)

Investment trusts often trade at a discount or premium to their NAV. As of recent data, FCIT trades at a 9% discount to its net assets, presenting a potential opportunity for investors to acquire shares below the intrinsic value of the underlying assets.

Market Capitalization and Assets Under Management

The F&C Investment Trust boasts a market capitalization of approximately £5.43 billion, with total assets under management around £6.27 billion. This substantial asset base enables the trust to invest in a wide array of opportunities, enhancing its diversification and potential for returns.

Expense Ratio

The trust maintains an annual management charge of 0.3% of net assets, with an ongoing charge of 0.80%. This competitive expense ratio ensures that a significant portion of returns is passed on to investors, enhancing the attractiveness of the trust as a long-term investment vehicle.

Gearing

Gearing, or the use of borrowed funds to enhance returns, stands at approximately 6% for FCIT. While gearing can amplify gains, it also introduces additional risk, necessitating careful management to balance potential rewards against the associated risks.

Analyst Perspectives

Analysts view the F&C Investment Trust as a solid option for investors seeking diversified global exposure with a proven track record. Its consistent dividend growth, experienced management, and strategic asset allocation contribute to its reputation as a reliable investment choice. However, potential investors should consider factors such as the current discount to NAV, market volatility, and the trust’s specific sector exposures when making investment decisio

FAQs

What is the current share price of F&C Investment Trust?

As of December 31, 2024, the share price of FCIT was 1,117.00 GBX, reflecting a 0.45% increase from the previous trading session.

Over the past 12 months, the share price has appreciated by approximately 16.72%, indicating robust performance amid global market fluctuations.

How has the share price performed historically?

Over the years, F&C Investment Trust has demonstrated resilience and adaptability, navigating various market cycles and economic upheavals. Its long-term performance has been commendable, with a total return exceeding 700% over the past two decades.

This impressive growth is attributed to its diversified investment strategy, encompassing sectors such as healthcare, technology, and real estate.

What factors influence the share price of FCIT?

Several factors can impact the share price of F&C Investment Trust:

Market Conditions: Global economic trends and market sentiment can affect the valuation of the trust’s holdings.

Portfolio Performance: The success of the companies within the trust’s portfolio directly influences its overall value.

Currency Fluctuations: Since the trust invests internationally, changes in exchange rates can impact returns.

Dividend Announcements: Regular and increasing dividends can attract investors, potentially boosting the share price.

What is the dividend policy of F&C Investment Trust?

The trust has a strong track record of dividend payments, having increased its dividends for 53 consecutive years.

This consistent income stream is a testament to its prudent management and diversified portfolio. The current dividend yield is approximately 1.33%, with dividends distributed quarterly.

What is the Net Asset Value (NAV) and how does it relate to the share price?

The Net Asset Value (NAV) represents the total value of the trust’s assets minus its liabilities, divided by the number of outstanding shares. Investment trusts often trade at a discount or premium to their NAV. As of recent data, FCIT trades at a 9% discount to its net assets, presenting a potential opportunity for investors to acquire shares below the intrinsic value of the underlying assets.

In Summary

F&C Investment Trust stands as a testament to the enduring appeal of diversified, globally focused investment strategies. Its consistent performance, prudent management, and commitment to shareholder returns make it a compelling choice for both novice and seasoned investors seeking long-term growth and income. The trust’s ability to adapt to changing market conditions while maintaining a steady dividend policy underscores its resilience and reliability.

Investors should consider factors such as the current discount to NAV, market volatility, and the trust’s specific sector exposures when making investment decisions. As with any investment, it’s essential to conduct thorough research, assess individual financial goals, and consult with financial advisors to ensure alignment with one’s investment strategy.

In summary, F&C Investment Trust offers a unique opportunity to participate in a diversified portfolio with a proven track record, making it a noteworthy consideration for those aiming to build a robust and resilient investment portfolio.

To read more, Click here.